north carolina estate tax certification

These files may not be suitable for users of assistive technology. An estate or trust that is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file the corresponding North Carolina income tax return.

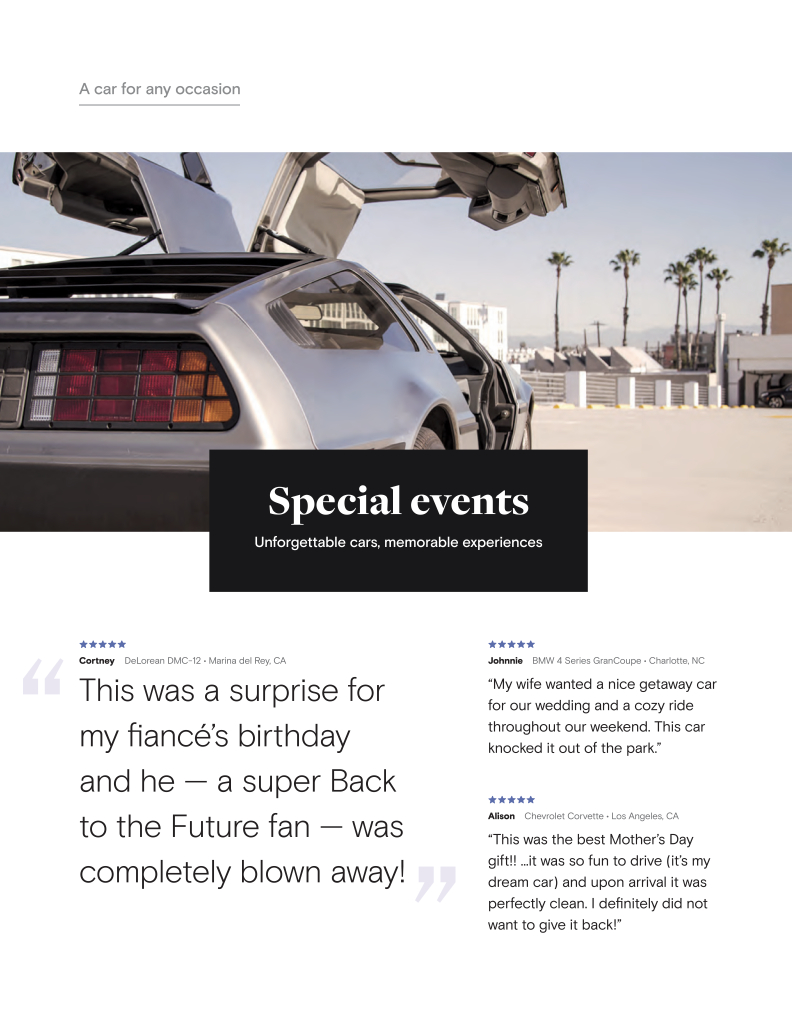

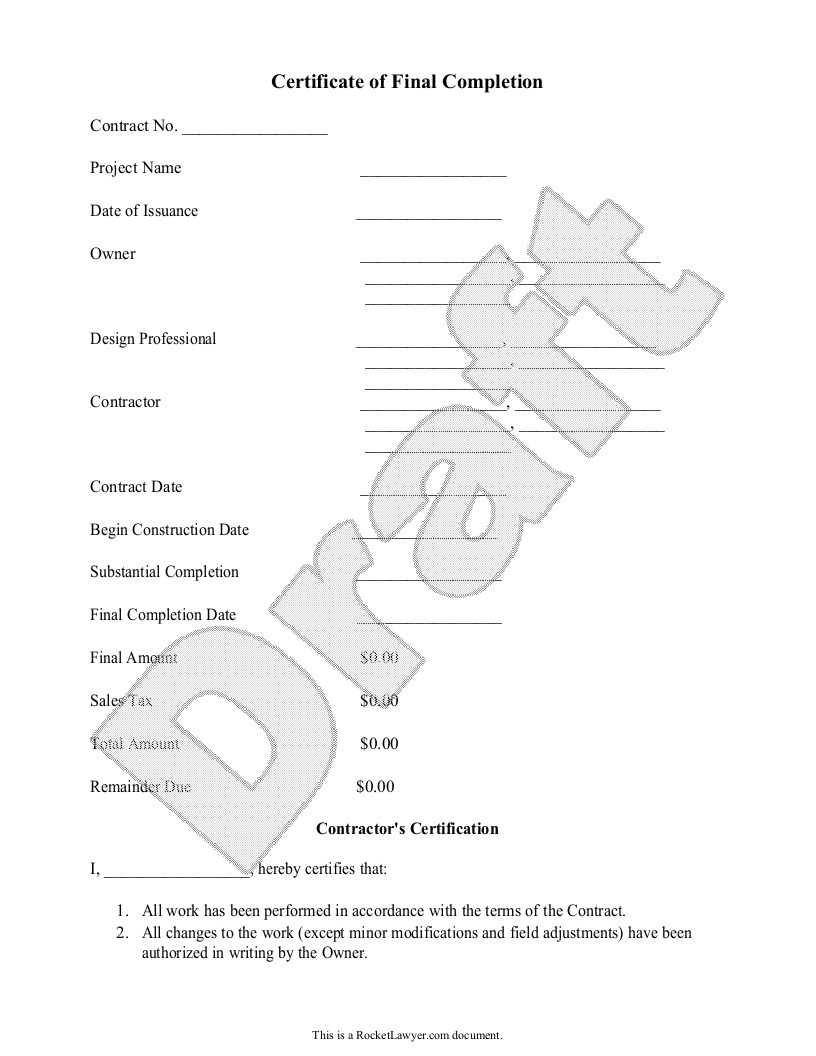

Free Certificate Of Final Completion Rocket Lawyer

In the General Court Of Justice Before The Clerk County IN THE MATTER OF THE ESTATE OF INHERITANCE AND ESTATE TAX CERTIFICATION FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999.

. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. This form should be completed if the North Carolina Decedent passed away on or after January 1 1999.

Division of Water Resources Tax Certification. Estate Tax Certification For Decedents Dying On Or After 1199. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

2 Get a resale certificate fast. However there are 2 important exceptions to this rule. The North Carolina County reviewing the tax status of the estate must be reported along with the file number it has assigned to this matter.

If you are having trouble accessing these files you may request an accessible format. Affidavit Of Notice To Creditors. Inheritance and Estate Tax Certification STATE OF NORTH CAROLINA File No.

During the three years preceding application. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. Appointment of Resident Process Agent.

A fee will be due when the account is filed. What Is the Estate Tax. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

Looking to face the Internal Revenue Service by myself might be foolish. The following table may be used to verify data in our records for those individuals. All beneficiariesheirs must be listed on the form with full names and addresses 3.

Duty to Furnish a Certificate-On the request of any of the persons prescribed in subdivision a 2 below the tax collector shall furnish a written certificate stating the amount of taxes and special assessments for the. Inheritance And Estate Tax Certification Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form Inheritance And Estate Tax Certification Form. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. This is a North Carolina form and can be use in Estate Statewide. North Carolina is not one of those states.

To receive an automatic State extension the estate or trust must certify on the North Carolina tax return that it was granted an automatic federal extension. This is a North Carolina form and can be use in Estate Statewide. There is a federal estate tax and some states also levy a local estate tax.

At least 72 hours of CLE credits in estate planning and related fields. The estate tax sometimes referred to as the death tax is a tax levied against the estate of a recently deceased person before the money passes to the designated heirs. Fill out the Affidavit for Collection of Personal Property of Decedent AOC-E-203B 2.

Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate. Provide basic information about your name phone number and address. Instant access to fillable Microsoft Word or PDF forms.

Its you can youll. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets. An Estate Tax Certification Form No.

STEPS FOR Qualification 1. North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes.

At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the related areas of elder law Medicaid planning and guardianship. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. USLF amends and updates the forms.

Here is a step-by-step guide on how to fill out this important form. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. USLF amends and updates the forms.

Inheritance And Estate Tax Certification. Estate Tax Certification For Decedents Dying On Or After 1 1 99 Form. AOC-E 212 OR an Inheritance and Estate Tax Certificate issued by the North Carolina Department of Revenue will need to be completed by the time you file the final account.

Key in the North Carolina Sales and Use Tax Permit Number. Remember therere abilityed in the ability of intimidation. The estate tax is different from the inheritance tax.

If you believe the data in this table is incorrect please notify Dave Duty in the. Waiver Of Personal Representatives Bond. Download North Carolina Sales and Use Tax Resale Certificate.

Inheritance And Estate Tax Certification E-207 North Carolina Statewide Estate Find a Lawyer. Basic Instructions After Qualification. In accordance with NCGS 105-2758 real or personal property used exclusively for waste disposal or for the abatement reduction or prevention of water pollution can qualify for special taxation considerationsIn order to qualify for these considerations for water pollution facilities or equipment four specific criteria must be.

County Assessor and Appraiser Certifications. Estate Tax Certification 87 North Carolina County Information. Ad 1 Fill out a simple application.

North Carolina Estate Procedures. 88 North Carolina Decedent Name.

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Do I Need A Lawyer For Arbitration Findlaw

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Trust Estate Planning Cpe Webinars Mycpe

Property Tax Certification Probate Pr E Lp 037 Pdf Fpdf Doc Docx

5 17 2 Federal Tax Liens Internal Revenue Service

Trust Estate Planning Cpe Webinars Mycpe

Cpa Cpe Requirements For North Carolina Nc Cpas Mycpe

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Form Power Of Attorney Job Application Template